What’s the deal with the price of Bitcoin?

The Bitcoin exchange traded funds (ETFs) have been approved. Mom and Pop are now putting tens of thousands of BTC into retirement accounts. So why isn’t the price going up?

It turns out that every crypto milestone is a sell-the-news event, at least in the short term. SEC approval of the Bitcoin ETFs might have become the largest sell-the-news event in history, with now $5B in sales after the approval. How is it possible that opening up Bitcoin investment to a huge new market triggered more selling than buying?

The succinct answer: Grayscale, a longtime Bitcoin player, has been liquidating billions of dollars worth of BTC since ETF approval. Imagine a bucket of water. Ten people are gathered around the bucket. Nine of the ten people are thirsty, using straws to suck out water as fast as possible without puking. But one of the ten is a lunatic refilling the bucket with a firehose. The bucket is Coinbase. The thirsty drinkers are the Bitcoin ETFs, and the lunatic with the hose is the Grayscale Bitcoin Trust.

Grayscale launched a Bitcoin Trust (GBTC) in 2013. Much like today's Bitcoin ETFs, the trust accumulated BTC and offered investors exposure to the asset. Without SEC approval, the fund could only be traded over-the-counter rather than on public exchanges. The SEC denied numerous applications to convert GBTC into an ETF.

Even though it wasn’t an ETF, GBTC provided investors a unique opportunity, and so accumulated a lot of Bitcoin. Grayscale became one of the largest single HODLers, at one point holding more than 3% of all the world’s BTC. GBTC was expensive to use, charging steep fees. Grayscale has been such a convoluted mess that I haven't written much about it in the newsletter. They’ve been fraught with scandals. Investors finding arbitrage opportunities with BTC/GBTC nearly wrecked the crypto market a few times over. GBTC was part of the Terra Luna crash, and FTX as well.

But GBTC stood alone as the only means for traditional investment in Bitcoin, and that's because the SEC denied, deferred, and delayed the real Bitcoin ETF decision for over a decade. Now that the SEC has finally done its job, GBTC holders are selling to convert their shares into other EFTs, and Grayscale is dumping billions of dollars worth of BTC on the market.

When a financial service has a large amount to invest or divest, they generally spread the activity into several smaller transactions to 1) dollar cost average, and 2) minimize disrupting the market. If you gave a wealth manager a million dollars to invest, they'd likely recommend spreading the purchases over 12 months. That's happening today with BTC ETF investment at Blackrock and Fidelity, and the rest of the ETF providers.

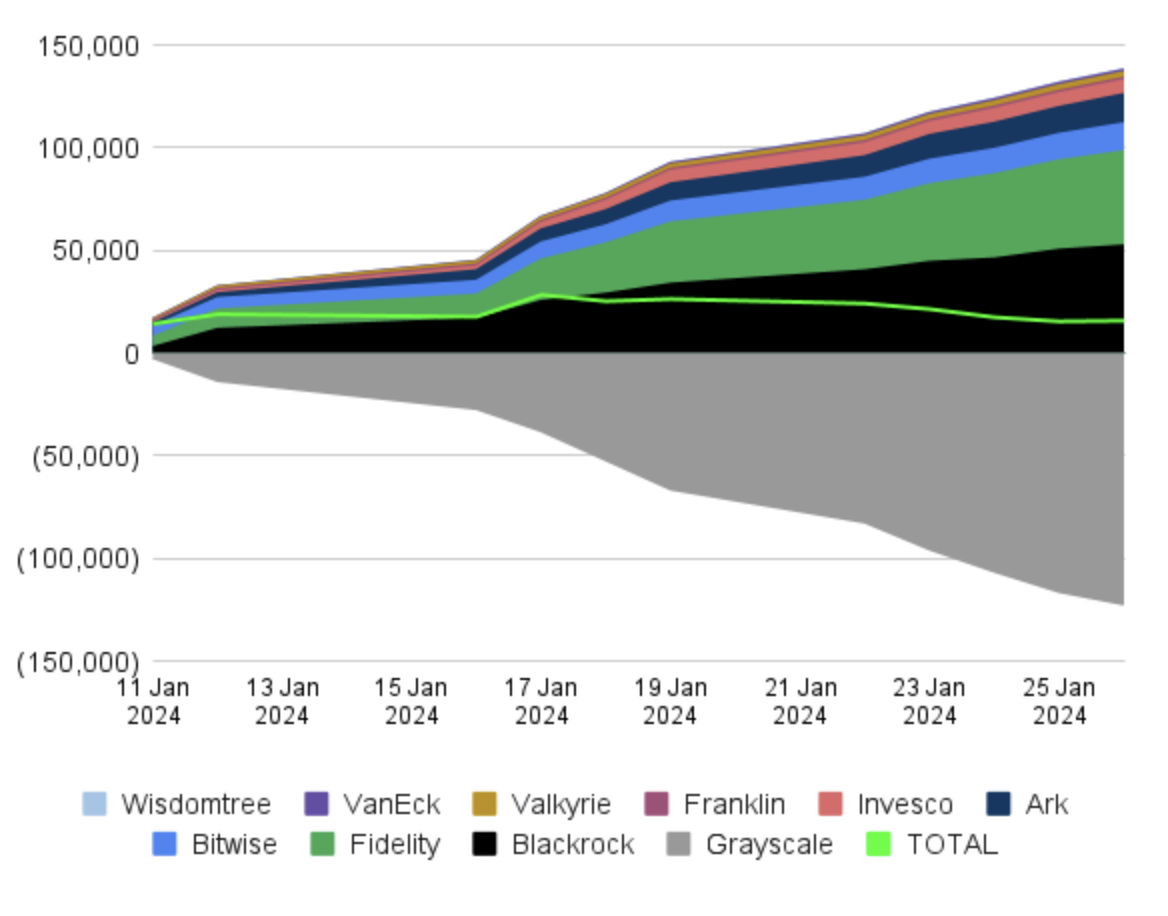

Grayscale is doing the same thing, but on the selling side, currently unloading BTC in huge chunks, all day every day. Early on they outpaced the inflows, and have now sold 125K BTC, $4B! Even though they're spacing out the sales, that amount of coin pouring into the market drives the price down and holds it there. When Michael Saylor buys $1B in BTC, the market moves. So when Grayscale sells $4B, you'd better believe the price drops.

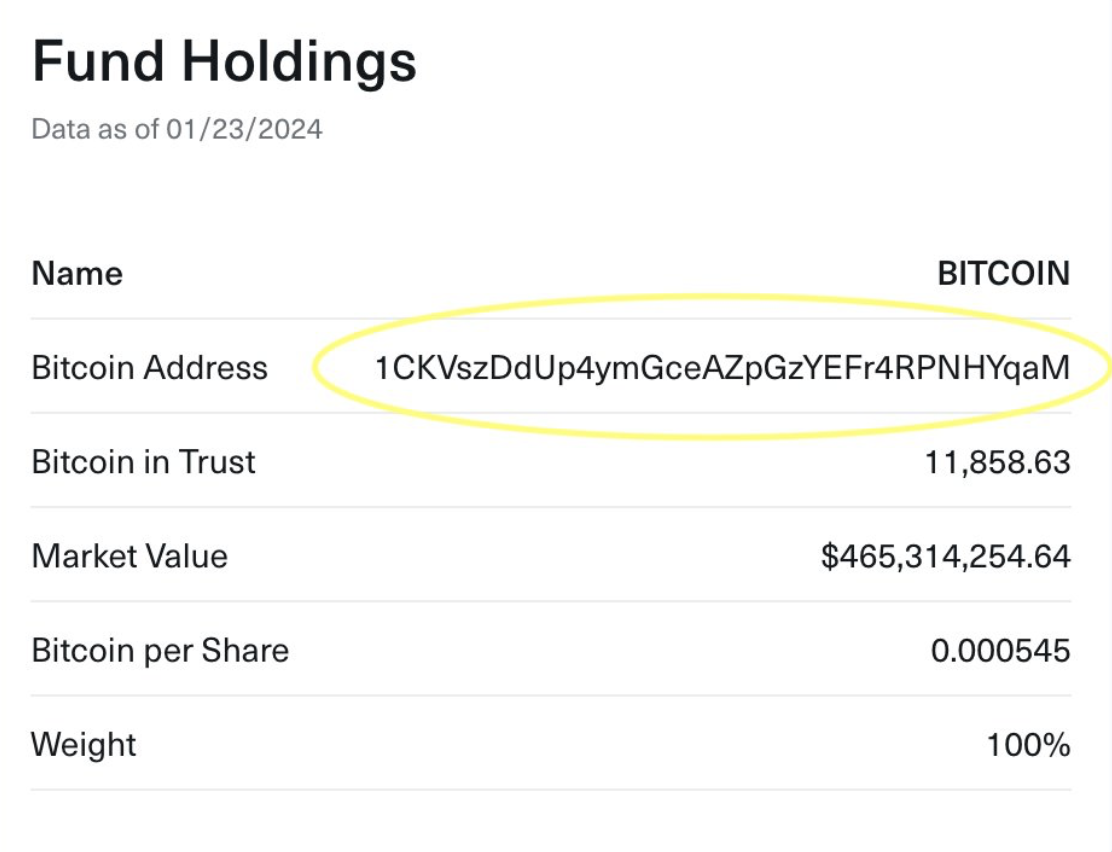

As of today the Bitcoin ETFs have steadily gobbled up almost as much as Grayscale has dumped, and prices have recovered a bit. Side note: for anyone who thinks EFTs are holding "paper" bitcoin, Bitwise ($BITB) has made public their custodial wallet address for the world to verify. I challenge you to find another commodity fund with that level of instant transparency; it's an exciting moment!

So the nine ETFs are still sucking up the Bitcoin at a fast pace, buying around 12,700 BTC every day. For context, only 783 new Bitcoins were issued yesterday. Even with all that buying, the ETFs are still dollar cost averaging their purchases, moving as fast as their risk models allow (but probably too slowly for their hungry customers). Their pace is fast, and only now catching up to the GBTC sell off. To make matters worse, the FTX bankruptcy sales are also underway, with liquidators dumping another $1B GBTC shares to make creditors whole. This chart tells the story (though it does not include the FTX liquidation).

Grayscale selling tipped the scales toward market surplus. The good news is that Grayscale and FTX will eventually run out of BTC to sell and the market will reach equilibrium, and then ETF investment will swing the market into a shortage, with prices responding accordingly.

When will Grayscale stop selling? They've sold 125K of their 600K BTC, and have only just started to slow down. If they liquidate much more of it, prices could struggle in the short term. Some smart, rational people warn of a drop into the $20-30K range. While that would be painful, once we can get beyond the enormous Grayscale sell pressure the ETFs will suck the bucket dry in a hurry.

Highly recommend checking out Farside Investors site for fantastic info on this topic: